I Need a Bankruptcy Lawyer

For some people, bankruptcy is seen as the right option for their families because it establishes a fresh financial start. If you are considering Chapter 7 Bankruptcy or Chapter 13 Bankruptcy, call (888) 473-6137 today to be connected with highly qualified Tampa bankruptcy lawyers who can help you navigate and choose your best financial option based on your specific circumstance.

Chapter 7 Bankruptcy

The key selling point of bankruptcy is that it gives honest debtors a “fresh start” by discharging certain debts. When filing Chapter 7 bankruptcy, individuals can keep their home, vehicle and other exempt property, as well as vanquish most of their unsecured debts such as: credit cards, personal loans, medical bills, repossession deficiencies and certain taxes.

However, the top benefit for filing a Chapter 7 Bankruptcy is the debtor has no liability for discharged debts. Please note that a discharge is only available to individual debtors, not to partnerships or corporations, and not all debts qualify for discharge.

In order to claim Chapter 7 Bankruptcy in Tampa, FL, one must file a petition with the United States Bankruptcy Court Middle District of Florida.

In addition, one must file the following items with the bankruptcy court:

- Schedules of assets and liabilities

- Schedule of current income and expenditures

- Statement of financial affairs

- Schedule of executory contracts and unexpired leases

- Copy of the return from the most recent tax year

- Tax returns filed during the bankruptcy case

Filing a petition under Chapter 7 Bankruptcy automatically puts an end to collection actions performed by the creditor. The bankruptcy court gives a notice of the bankruptcy case to all creditors listed on the documentation provided by the debtor. Once this notice is given, a creditor cannot continue to pursue lawsuits, wage garnishments, or even make telephone calls in an attempt to collect the debt.

If you primarily have consumer debts then you may have additional documents that you are required to submit. An experienced bankruptcy attorney will make sure that all of your required bankruptcy paperwork is accurately filed with the bankruptcy court and in a timely manner.

Chapter 13 Bankruptcy

Chapter 13 Bankruptcy gives debtors a way to stop the foreclosure process and keep their home, eliminate second or third mortgages, catch up on past due car payments, as well as eliminate credit cards, medical bills and other unsecured debt. Chapter 13 Bankruptcy (also known as a “wage earner’s plan”) is very similar to debt consolidation. If you choose to file Chapter 13 Bankruptcy, and have a regular income, then you will be given the opportunity to pay off all or part of your debt through a repayment plan. At the end of the repayment plan, which typically last three to five years, any remaining balances are “discharged” or “wiped out.”

Although it can take up to five years to complete your debt repayment plan, Chapter 13 Bankruptcy affords debtors more flexibility in terms of payments. Under Chapter 13 Bankruptcy, it is possible to have your payment amounts reduced and to stretch out your payments. When you let go of an item that you are currently paying on then your monthly payments will be reduced accordingly.

Filing for Bankruptcy When Married

A husband and wife may file a joint petition or individual petitions for bankruptcy, however, they are still subject to providing all the documentation required of an individual debtor. Even if only one spouse is filing for bankruptcy, the court still requires the income and expenses of the non-filing spouse be provided so that the household’s overall financial state can be evaluated in the bankruptcy case.

When filing for bankruptcy as a married couple you can expect the following:

- An immediate notice given to creditors that they cannot legally contact you for any reason.

- Complete two financial education courses.

- Attend a meeting of creditors.

- Attend a discharge hearing to finalize your case (as long as no one objects to your bankruptcy)

- May be required to turn over any property if a bankruptcy judge or trustee requires you to relinquish assets.

-

If you filed Chapter 13, the plan goes into effect:

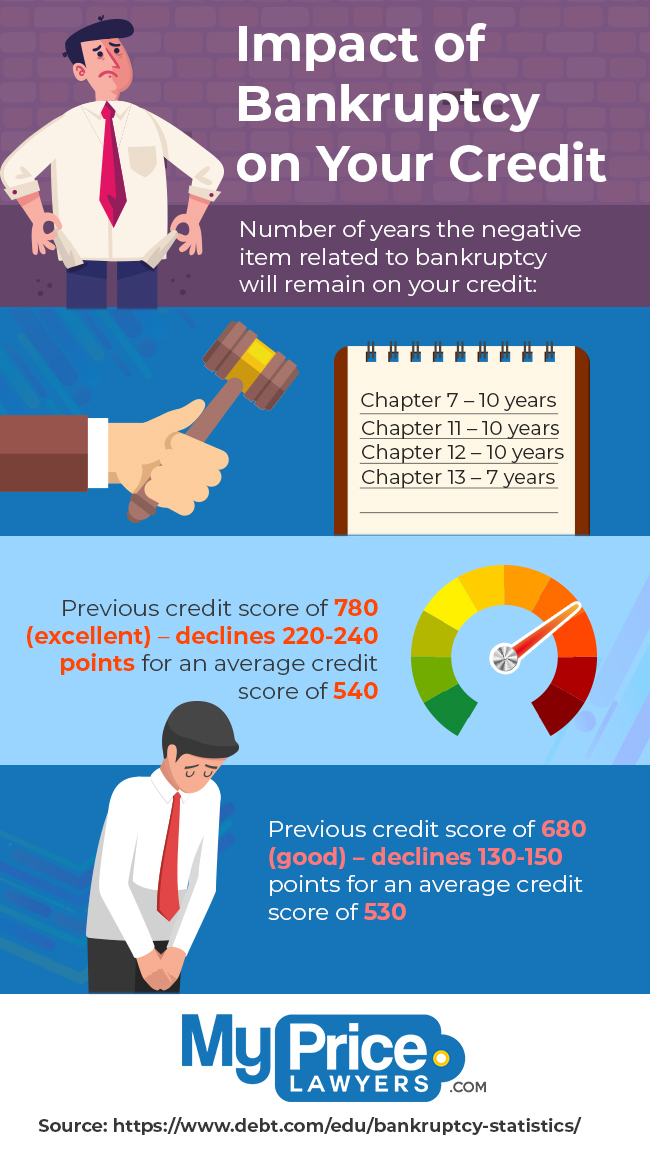

-An entry is placed on your credit report.

-Qualifying debts are discharged.

-You start rebuilding credit and get a fresh financial start.

Bankruptcy Court

In order to claim bankruptcy, the first step a debtor must take is to file a petition with the bankruptcy court. All bankruptcy cases are overseen in federal courts and are governed by the rules of the U.S. Bankruptcy Code. Bankruptcy court was established by congress in 1978 and settles all types of personal and corporate bankruptcy cases.

Here’s what you should know about bankruptcy court:

- Bankruptcy courts are located around the U.S. and solely handle bankruptcy cases and related legal matters.

- Deadlines are critical in bankruptcy court. Failing to file the appropriate and necessary documentation within the given deadline can negatively impact your case by having it delayed or outright dismissed.

- New federal regulations have made it difficult to be given complete debt relief in bankruptcy court. Complete discharge of your debt is greatly determined using the Means Test.

- The exemptions that you choose to claim in bankruptcy court will directly determine whether or not your assets should be seized and sold to provide payment to your creditors.

- The penalties for lying in bankruptcy court are severe. It is of most importance that you try to be as honest as possible to avoid penalties or sanctions.

You have the option to attend bankruptcy court without a lawyer, which is known as filing pro se. Because bankruptcy has long-term financial and legal consequences it is highly recommended that you have a qualified bankruptcy lawyer by your side in bankruptcy court. The consequences of providing misleading information or hiding assets are detrimental. Bankruptcy lawyers are very knowledgeable in bankruptcy law and will fight to get the best results possible for you.

Bankruptcy Fraud

A high percentage of bankruptcy fraud cases involve the debtor not disclosing all of their property and assets. When you file for bankruptcy you are required to present a list of all the property that you currently own along with any and all assets that you have transferred over to another individual within a given period of time.

Debtors also commit fraud when they intentionally provide bankruptcy forms with false, incomplete or misleading information. Placing false information on official government documents may constitute perjury. Perjury is punishable by fines up to $250,000 and up to five years in prison. Another form of bankruptcy fraud is when an individual files multiple times in various jurisdictions, regardless if their documentation is true or false. Bribing a court-appointed trustee is also considered a form of bankruptcy fraud.

If you are suspected of committing bankruptcy fraud, federal prosecutors may bring criminal charges against you. That is why having an experienced and skilled bankruptcy lawyer by your side is so important. Our low-cost bankruptcy lawyers ensure that their clients are aware of the law and do not unknowingly commit acts of bankruptcy fraud. In fact, our low-cost bankruptcy lawyers gather, evaluate and file any and all required legal documentation on your behalf.